Insights,

Insights,

ADVI expert Farooq Tirmizi, vice president of mergers and acquisitions (M&A) advisory, talks about the headwinds and tailwinds for skilled nursing facilities (SNF) including the pandemic’s impact on SNF, Medicare Advantage penetration, increasing post-acute care utilization, and of course the surge in the aging senior population.

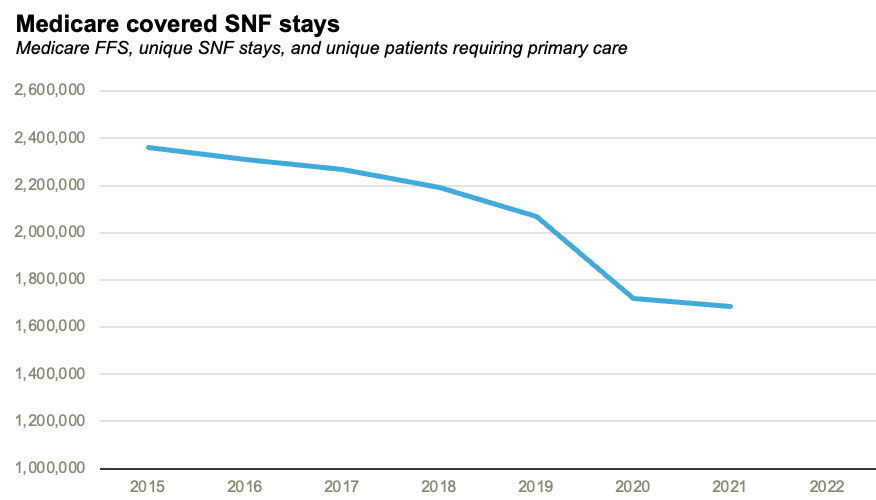

Part of what is highlighted is that the pandemic hit SNF capacity right before a surge in demand. SNF volumes nosedived during the pandemic, largely due to an increased preference for home health during the worst of the COVID-19 outbreaks in nursing homes.

Source: ADVI SAVEs analysis of data from the Medicare Part A Standard Analytical Files, and MedPAC.

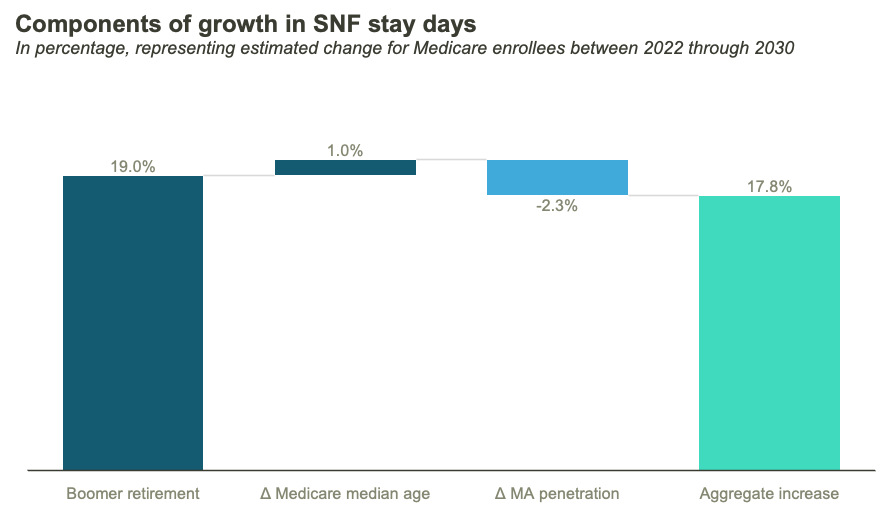

Total SNF stay days in the Medicare population are expected to go up by 17.8% by 2030, of which the bulk of the increase is the result of the retirement of the Baby Boomers, with increased MA penetration causing only a small decrease in utilization.

Expert Commentary

Hear more from Farooq on the emerging opportunities for private equity investors interested in skilled nursing facilities.

Learn More

Stay ahead of the curve. Get in touch today to gain expert insights and the evolving healthcare landscape.

Advisor, Financial Services