ADVI Instant: Draft Guidance for the “Medicare Rx Payment Plan” Program Release

On August 21, 2023, the Centers for Medicare and Medicaid Services (CMS) released the Draft Part 1 Guidance on the Maximum Monthly Cap on Cost-Sharing Payments Program (also known as “copay smoothing”) established through the Inflation Reduction Act (link), which CMS will now also refer to as the “Medicare Prescription Payment Plan” program. CMS released an accompanying fact sheet (link) and timeline (link).

This guidance focuses on implementation of the program for 2025 and addresses an initial set of topics, including monthly calculations, participant billing, pharmacy payment obligations, enrollee outreach and election, and procedures for participant termination, reinstatement, and preclusion.

Comments on the Draft Part 1 Guidance are due September 20, 2023, and can be sent to PartDPaymentPolicy@cms.hhs.gov with the subject line “Medicare Prescription Payment Plan Guidance.”

CMS states that it will release the Draft Part 2 Guidance, as well as model language and supporting materials, by early 2024. CMS expects to finalize the Draft Part 1 Guidance by spring 2024 and the Draft Part 2 Guidance by spring or summer 2024.

Below are highlights of the Draft Part 1 Guidance. If you have any questions or would like further information, please do not hesitate to contact your ADVI Account Manager.

The Inflation Reduction Act (IRA) requires Part D plan sponsors to offer all enrollees the option to pay their out-of-pocket (OOP) costs in monthly installments over the plan year (also known as copay smoothing). Part D enrollees in the program will pay $0 at point of service (POS). Instead, the Part D sponsor will pay the pharmacy the required cost-sharing and bill beneficiaries monthly for incurred cost sharing throughout the year. Once enrolled, plan sponsors must include all covered Part D drugs in the program (non-covered drugs are excluded).

CMS is voluntarily soliciting comment on all sections of the Medicare Prescription Payment Plan (MPPP) Draft Part 1 Guidance, but specifically requests feedback on participant billing, pharmacy obligations and claims processing, enrollee outreach and election requirements, procedures for termination of election and reinstatement, participant disputes, and data submission requirements. CMS is also seeking comment on the best ways to educate Part D enrollees about the program.

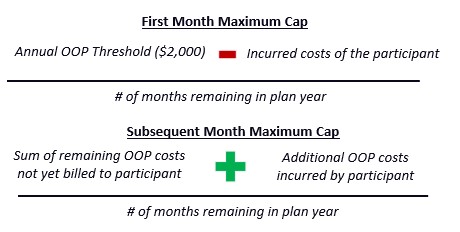

CMS restates the statutory formulas for determining OOP costs in the first month a beneficiary enrolls in the program and subsequent months.

As noted in previous CMS communications, in the first month of participation, Part D sponsors must bill the beneficiary the lesser of the actual OOP costs or the first month’s maximum monthly cap. The maximum monthly cap for subsequent months repeats through the remainder of the year but may change if additional OOP costs are incurred.

CMS provides several example calculations and notes the following:

- If an enrollee in the program fills a prescription for an extended day supply, their OOP costs will be attributed to the month the prescription was filled.

- “OOP costs incurred by the beneficiary” refers only to the portion patients would have paid if they did not opt into the program and excludes other amounts paid by third parties, such as manufacturer patient assistance programs.

Participant Billing Requirements

Part D sponsors are required to bill MPPP participants who incur OOP costs an amount for each month that cannot exceed the applicable maximum monthly cap. For each monthly billing period, the Part D sponsor will calculate an amount that considers the OOP costs in that month. CMS specifies that:

- While a Part D sponsor cannot bill a participant an amount that is more than the maximum monthly cap, the participant can pay up to the annual OOP threshold; however, they cannot pay more than their total OOP costs.

- Part D sponsors cannot bill a participant who is in the program but has not yet incurred any OOP costs during the plan year.

- Part D sponsors must have a financial reconciliation process in place to correct inaccuracies in billing/payments.

- Because Part D sponsors cannot bill a participant more than the maximum monthly cap, other fees (i.e., late fees, interest payments) are not permitted.

- Billing statements are required to contain certain details, including MPPP and LIS program information, the effective date of participation, billing specifics (e.g., last payment amount/date/means, payment balance/missed payments, itemized OOP costs, amount due, remaining OOP cost sharing balance, etc.), and resolution processes.

CMS encourages Part D sponsors to offer multiple means of payment and payment flexibility and to work with participants to prioritize payments towards plan premiums over the MPPP balance to help them avoid losing Part D coverage. CMS is requesting comments regarding debt collection for amounts due under the program and additional financial reconciliation standards that may be appropriate for the program.

Pharmacy Payment Obligations and Claims Processing

- As Part D patients who participate in MPPP will pay $0 OOP at the POS, Part D sponsors are required to pay the pharmacy both the enrollee’s cost-sharing and the sponsor’s portions of the payment.

- Network pharmacies are to be reimbursed within 14 days of receipt of an electronic claim and within 30 days of receipt of all other claims; for long-term care and home infusion pharmacies, all current payment practices are to be observed.

- Because of potential implementation challenges, CMS is proposing an electronic claims processing methodology where two transactions would be submitted for each claim: One for the initial Part D claim adjudication and a second to process the final participant liability amount as a MPPP.

- This approach is being proposed in order to offer a “timely, uniform, and seamless” process for all program participants.

- CMS is requesting comments on the examples provided and is soliciting alternate claims processing options that may fit the need (and for the potential of paper claims).

- Additional pharmacy transaction costs or fees are considered allowable pharmacy costs to be paid through applicable dispensing fees.

General outreach requirements

- Part D sponsors are required to provide MPPP information and educational materials to beneficiaries. Specifically, Part D sponsors must include information about the MPPP through marketing and communication materials during open enrollment. CMS is seeking comment on which materials would benefit from CMS templates, samples, or model language.

Targeted outreach requirements

- Part D sponsors are also required to conduct targeted outreach directly to enrollees “likely to benefit” from the MPPP before and during the plan year. CMS describes “likely to benefit” enrollees as those whose highest monthly OOP cost would be more than the highest monthly paid amount under the MPPP. CMS notes that Part D enrollees with high OOP costs earlier in the plan year are more likely to benefit from participating.

- The targeted outreach must also include notifications from the sponsor to the pharmacy at the POS that a Part D enrollee may benefit from the MPPP, based on if an enrollee is incurring OOP costs for a single prescription that equals or exceeds the POS threshold. Upon receiving the notification, the pharmacy will be required to inform the Part D enrollee that they may benefit from the MPPP, as well as information on how to opt into the program. CMS notes that Part D enrollees should not be notified about the MPPP in the last month of the plan year or if they are already participating in the MPPP.

- CMS is seeking comment on the following aspects of the targeted outreach:

- A range of potential POS notification thresholds from $400 to $700

- Factors to consider when determining the POS notification threshold for 2025, including using a single prescription versus a single day accumulation to count toward the threshold

- Alternative notification processes for different types of pharmacies (e.g., retail, mail order, home infusion)

CMS will provide additional marketing and communications information in the Draft Part 2 Guidance, which will include.

- Pharmacy communications

- Model language and standardized materials, including language about the availability of LIS under Part D

- Specific parameters for identifying “likely to benefit” enrollees both before and during the plan year

- Additional details on the pharmacy notification process

- For plan year 2025, Part D enrollees or their legal representative may opt-in to the MPPP before or during the plan year by completing an election request in one of four available mechanisms:

- An election option through the Part D (or MA-PD) plan enrollment process

- A paper option that can be faxed or mailed

- A toll-free telephone number, that must provide the individual with evidence the election request was received (i.e., a confirmation number)

- A website application that must provide the individual with evidence the election request was received (i.e., a confirmation number)

- To support election requests prior to the start of a plan year, Part D sponsors must integrate information about the MPPP election request process for beneficiaries enrolling in a new plan (in materials and procedures for plan enrollment) as well as those remaining in the same plan (through annual notices).

- Part D sponsors are required to approve elections, request more/missing information, or issue denials:

- Within 10 days of receipt for pre-plan year requests

- Within 24 hours of receipt for mid-plan year requests

- Once approved, Part D sponsors must provide participants with:

- A program overview and procedures

- Example calculations

- Information on LIS program and enrollment

- CMS acknowledges that although the MPPP is unlikely to benefit LIS enrollees, there are limited circumstances where it may be advantageous. As such, Part D sponsors must provide the option to opt into the MPPP to all Part D enrollees, including LIS-eligible individuals.

- The effective date of participation

CMS states it will provide additional requirements and model language about the MPPP, enrollees’ rights, and Part D sponsor responsibilities related to Part D enrollees participating in the LIS program in the Draft Part 2 Guidance.

- Within 45 days, Part D sponsors must reimburse participants for any excess payments made as a result of:

- The individual gaining LIS status effective retroactively

- The Part D sponsor failing to process an MPPP election within 24 hours

- Urgent claims for which beneficiaries paid POS cost-sharing and later (within 72 hours) requested retroactive election

- For individuals who switch plans mid-year, the prior Part D sponsor may continue to bill the participant for accrued OOP costs owed and may offer the option to repay the outstanding amount in a lump sum (but may not require immediate repayment). The new Part D sponsor must calculate the monthly cap for the first month in the plan using the calculation of the maximum monthly cap in the first month.

- For plan year 2026, CMS is seeking input on how to effectuate real-time or near-real-time POS election. Specifically, CMS requests comments on the method of POS election (i.e., telephone-only, mobile or web-based application, or clarification code), as well as timeline and feasibility, potential technology and processes to leverage, implications for Part D enrollees, potential burden, and sequence of approach/method.

Procedures for Termination of Election, Reinstatement, and Preclusion

- Voluntary terminations

- Part D plan sponsors are required to have a process for beneficiaries who opt into the program to opt out of the program during the plan year.

- Involuntary terminations

- Part D sponsors must terminate beneficiaries that fail to pay their monthly billed amount after the required grace period of at least 2 months. Individuals cannot be removed from the program if they pay the overdue balance during the grace period.

- Part D sponsors must send the following:

- If a beneficiary misses a monthly payment, Part D sponsors must send an initial notice within 15 calendar days of the payment due date explaining that the individual will be terminated if they do not pay the balance within the grace period.

- A termination notice sent within 3 days after the end of the grace period.

- Part D sponsors must reinstate individuals involuntarily terminated from the program who show “good cause” for failure to pay (circumstances over which the individual had no control). Sponsors may reinstate individuals who have repaid overdue amounts but did not show “good cause” at their discretion.

- After both voluntary and involuntary terminations, sponsors must continue to bill beneficiaries the monthly amount for the rest of the plan year or give beneficiaries the option to repay the remaining amount in a lump sum (a lump sum payment cannot be required). Beneficiaries will be responsible for paying the pharmacy directly for any new charges up to the annual OOP threshold ($2,000).

- In subsequent plan years, Part D sponsors may only prevent beneficiaries from opting into the program if they still owe an overdue balance. If the beneficiary has paid the outstanding balance, they must be allowed to opt back into the program.

- CMS emphasizes that Part D sponsors may only involuntarily disenroll a beneficiary from a Part D plan if the enrollee fails to pay the monthly premium or CMS grants a disenrollment request. Sponsors are prohibited from disenrolling beneficiaries from Part D plans, or declining future enrollment, for failure to pay a monthly amount under the MPPP.

Part D sponsors must apply their established appeals procedures to any dispute made by MPPP participants regarding their amount owed. Sponsors must also apply their grievance procedures to any dispute related to the MPPP program (i.e., election requests, billing requirements, termination-related issues unrelated to amount owed).

Data Submission Requirements

CMS will require Part D sponsors to report information related to the related to the MPPP on Prescription Drug Event (PDE) records and through new annual reporting requirements. PDE financials should reflect individual and plan liability amounts as if the Medicare Prescription Payment Plan did not apply.

For monitoring purposes, Part D sponsors will also be responsible for reporting MPPP data elements at the beneficiary-level and contract Plan Benefit Package (PBP) levels on an annual basis. Proposed data elements for the MPPP may include, but are not limited to:

- Beneficiary-level data elements, including name, date of birth, election termination reason code (voluntary versus involuntary)

- Contract-PBP-level data elements, including the total number of individuals identified as likely to benefit based on POS criteria, total uncollected MPPP balances, and the number of individuals prevented from opting back into the MPPP in subsequent years.

ADVI will continue monitoring developments and next steps. This is a delayed release. ADVI Instant content is distributed in real time for retainer clients. Get in touch to learn more about how we can support your commercialization, market access, and policy needs.